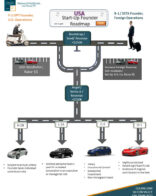

Our current immigration laws pose challenges to immigrants who want to start businesses and create jobs. While there have been legislative proposals for a “Start-Up Visa,” at present our immigration laws do not provide a clear path for immigration for entrepreneurs and for the employees of the companies they create.

Based in Silicon Valley, our firm has developed successful strategies for entrepreneurs seeking immigration status for themselves and their employees. Some of the available options and their opportunities and risks are presented below.

E-1 / E-2

E-1 (Treaty Traders) and E-2 (Treaty Investors) are non-immigrant work visas available to companies and individuals from specific countries that have diplomatic treaties and reciprocal trade agreements with the U.S. The E-1 and E-2 Treaty Trader / Investor visas can be highly advantageous for companies and individuals with qualifying treaty country nationality. One of the strongest benefits of E visas is they can be renewed indefinitely if the qualifying organization maintains its E visa status and qualification. Another major advantage is that the spouses of E visa holders can apply for US work authorization.

Notably, India does not have a treaty with the United States, and thus entrepreneurs from India would not qualify for this visa.

H-1B

The challenges of an H-1B for a start-up where the individual is also a shareholder relates to whether the individual’s employment is controlled by the employer company – i.e. can the individual be hired or fired? Having a Board of Directors that is different from and independent of the “H-1B Founder” is one way to establish the control over employment.

The other challenge is that while the company does not have to show an ability to pay, it does have to show that there is a viable business that would be paying for the H-1B salary.

Finally, the position itself will need to show that it requires someone with specialized knowledge.

L-1A

Where a company has a qualifying relationship with a foreign company, and the foreign national has been an employee of that foreign entity, the L-1A may be a good option for setting up a new office in the U.S.

O-1

A serial entrepreneur or otherwise successful entrepreneur may qualify for an O-1 if it can be established that he /she is extraordinary in business. This is a high standard to meet, but could be a good option for a foreign national who meets the criteria.

Paths toward Green Card

The O-1 and L-1A potentially have faster paths to the Green Card through the EB-1(a) and (c) categories, respectively.

While the O-1 has similar requirements to the EB-1(a) the standards for the EB-1(a) are more stringent and having O-1 does not guarantee the EB-1(a), but it is a good stepping stone.

For an EB-1(c), the petitioning U.S. company must have been doing business for at least 1 year prior to filing. While there is an exception for L-1A to open a new office, there is no similar exception for EB-1(c). Therefore for new offices, we would have to file only after the new office has been in business for 1 year.

Entrepreneurs in Residence Program

While the U.S. does not currently have a start-up visa, DHS has taken certain steps to provide resources and information for entrepreneurs and has educated its adjudicators about unique characteristics of entrepreneurs through its Entrepreneurs in Residence Program.

Investor Visa

A foreign national who has invested, or is in the process of investing, a certain amount of capital into a new commercial enterprise in the United States may be eligible for permanent resident status. In most cases, the alien will first obtain an EB-5 Visa which is available to foreign nationals who have invested 1 million dollars in a new commercial enterprise in the United States. The investor must also demonstrate that his or her new undertaking will create at least 10 full time jobs for American citizens or those authorized in the United States. To seek this status, the foreign national must file Form I-526, Immigrant Petition by Alien Entrepreneur. This form must be accompanied by supporting documentation demonstrating the alien’s eligibility.

Once the alien has entered the United States, he or she may file Form I-485, Application to Register Permanent Residence or Adjust Status to receive permanent resident status in the United States. With this petition, the foreign national must demonstrate that the newly created enterprise is still intact. To avoid fraud, investors seeking permanent resident status are initially granted a conditional Green Card which may be renewed after two years.